A partner can only file and sign an AAR on behalf of the partnership if they are also the partnership representative. Only the partnership representative can file and sign an AAR on behalf of the partnership.

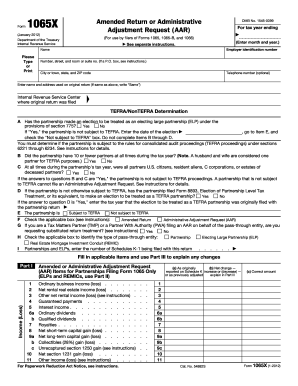

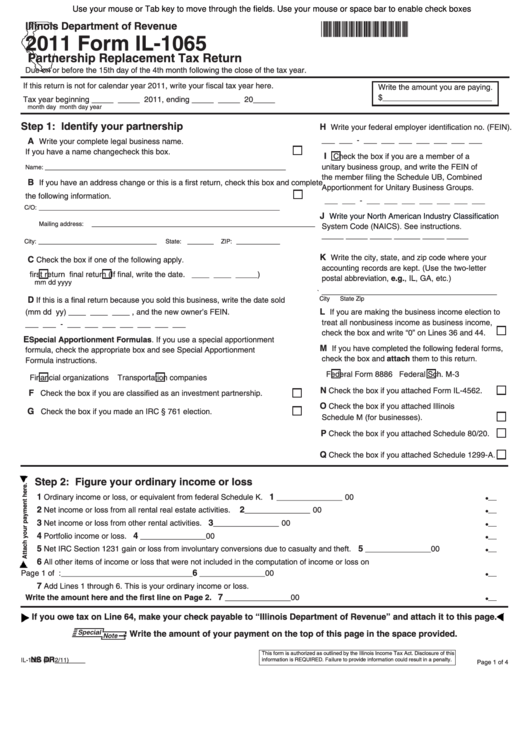

All other returns should be filed with Form 1065-X. If the original return was e-filed, the AAR must be e-filed with Form 8082, unless your tax software does not provide for e-filing these returns. Generally, this applies to partnerships for taxable years beginning after Dec. When Should I File an AAR?īBA partnerships should file an AAR when they need to make changes to already-filed partnership returns. Under the BBA procedures, partners can no longer amend their Form 1065 or Schedule K-1, and instead, must file an administrative adjustment request (AAR), unless the entity has elected out of CPAR.ĭue to the complexity of AARs, Doeren Mayhew’s dedicated business tax accountants provide answers to some FAQs below. The Bipartisan Budget Act (BBA) of 2015 replaced the auditing and tax collection procedures for partnerships under the Tax Equity and Fiscal Responsibility Act of 1982 and the electing large partnership rules and introduced a new centralized partnership audit regime (CPAR). By Ugo Onwudiegwu, CPA, Senior Tax Manager

0 kommentar(er)

0 kommentar(er)